Fed announces unprecedented aid to state and local governments

The Federal Reserve announced a remarkable new step to combat the economic upheaval from the coronavirus pandemic Thursday morning: For the first time ever, it will lend directly to state governments, local governments, and municipalities, by buying up to $500 billion of the bonds they issue.

Since the start of American lockdowns to contain the virus, the Fed has announced a raft of new measures to provide cheap lending to the financial industry, corporations and businesses, all in an effort to keep the economy afloat. These included offers to buy limited categories of state and local bonds from secondary dealers and markets. But this new program will buy those bonds directly from the governments that issue them. For each individual government, the Fed will lend them up to 20 percent of their revenue for 2017; and in total the Fed will lend up to $500 billion. Thanks to a sign-off by the Treasury Department, the Fed will also buy bonds with a maturity of up to 24 months. (Under its own normal powers, the Fed is limited to buying state and local debt of six months or less.)

This is much further than the central bank ever went in response to the Great Recession. Various policymakers and activists have been pushing the Fed to cross this bridge for a while. States, localities, and municipalities cannot borrow from private markets the same way the federal government can, and when economic downturns hit their tax revenue, they’re forced to cut their spending. That dynamic made the hole from the 2008 collapse much deeper than it otherwise would have been. This morning’s announcement is an effort to prevent that from happening again.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

A peek inside Europe’s luxury new sleeper bus

A peek inside Europe’s luxury new sleeper busThe Week Recommends Overnight service with stops across Switzerland and the Netherlands promises a comfortable no-fly adventure

-

Space data centers could be joining the orbit

Space data centers could be joining the orbitUnder the radar The AI revolution is going cosmic

-

Codeword: December 23, 2025

Codeword: December 23, 2025The daily codeword puzzle from The Week

-

CBS pulls ‘60 Minutes’ report on Trump deportees

CBS pulls ‘60 Minutes’ report on Trump deporteesSpeed Read An investigation into the deportations of Venezuelan migrants to El Salvador’s notorious prison was scrapped

-

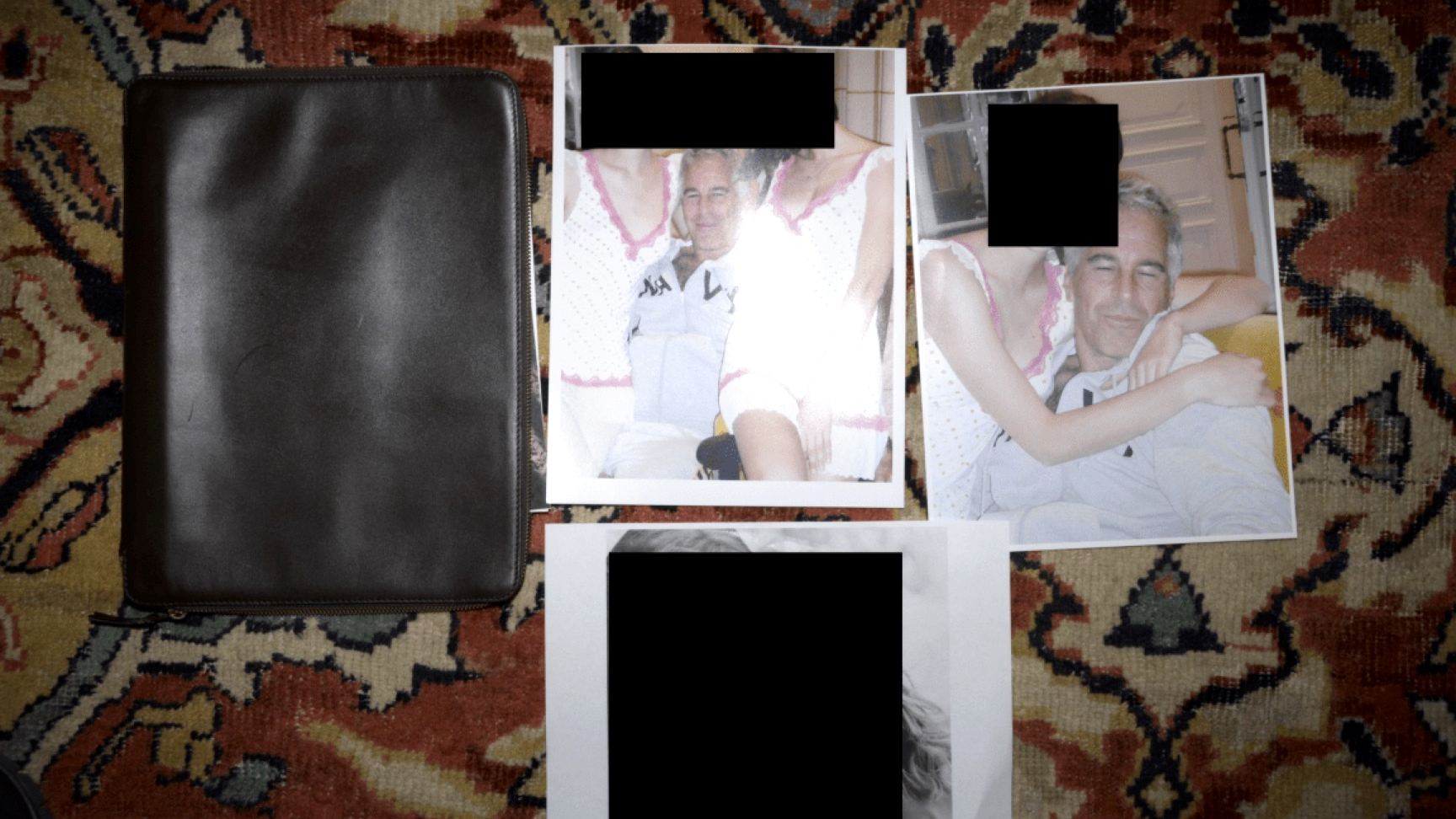

Trump administration posts sliver of Epstein files

Trump administration posts sliver of Epstein filesSpeed Read Many of the Justice Department documents were heavily redacted, though new photos of both Donald Trump and Bill Clinton emerged

-

Trump HHS moves to end care for trans youth

Trump HHS moves to end care for trans youthSpeed Read The administration is making sweeping proposals that would eliminate gender-affirming care for Americans under age 18

-

Jack Smith tells House of ‘proof’ of Trump’s crimes

Jack Smith tells House of ‘proof’ of Trump’s crimesSpeed Read President Donald Trump ‘engaged in a criminal scheme to overturn the results of the 2020 presidential election,’ hoarded classified documents and ‘repeatedly tried to obstruct justice’

-

House GOP revolt forces vote on ACA subsidies

House GOP revolt forces vote on ACA subsidiesSpeed Read The new health care bill would lower some costs but not extend expiring Affordable Care Act subsidies

-

Hegseth rejects release of full boat strike footage

Hegseth rejects release of full boat strike footageSpeed Read There are calls to release video of the military killing two survivors of a Sept. 2 missile strike on an alleged drug trafficking boat

-

Trump vows naval blockade of most Venezuelan oil

Trump vows naval blockade of most Venezuelan oilSpeed Read The announcement further escalates pressure on President Nicolás Maduro

-

Kushner drops Trump hotel project in Serbia

Kushner drops Trump hotel project in SerbiaSpeed Read Affinity Partners pulled out of a deal to finance a Trump-branded development in Belgrade